Often Equity Release is provided as the only solution for older borrowers. But today, I want to explore the full range of options available.

My drive and passion around this subject are all about choice and advice. The freedom to make choices and access professional and considered advice.

From a personal perspective, I look at my own parents and want them to spend what is theirs, enjoy retirement to the full and be comfortable in the choices they make!

As for the ‘alternative,’ this is not just about an ‘alternative’ for now, but about a well-thought-out plan. It might mean that Equity Release is the ‘right fit’ or the best solution in several years’ time, but for today, it is about exploring all options.

As a broker, I encourage you to consider what later life lending means to you. Do you see yourself as someone who handles it? Many brokers tell me they do not specialise in later life lending, but why not? If you have advised a client to take out a mortgage beyond retirement age, then in my view, you do – and you should not shy away from it.

Later life lending could be a great option for many people in retirement. The freedom that the right type of borrowing can bring in later years may be life-changing for those who embrace it. Life is for living, and I encourage you to help more clients do just that!

While equity release is absolutely one option, I want to focus on those customers who can afford monthly payments now, especially with long-term fixed rates.

Long-term fixed rates = stability for older borrowers

When it comes to securing a mortgage or a loan in later life, one of the big concerns for borrowers is interest rate volatility. Rising rates can lead to higher monthly payments, which is a concern for those on fixed incomes or pensions.

Protect your clients from rate changes and give them peace of mind.

With a Perenna mortgage, there are no early repayment charges after five years. This means your clients can explore options like Equity Release or others, without worrying about penalties.

Let’s look at those ‘alternatives’.

A traditional ‘term’ mortgage

Perenna has a genuine no maximum age policy. If a traditional mortgage is affordable, it may be the right option for some clients. With a long-term fixed rate mortgage, clients benefit from payment security while repaying capital, should that be their preference. This ties back to the point of financial freedom and choice in the here and now. The mortgage could be inherited along with the property when the time comes. The intergenerational aspect that these supports should be explored – after all, family homes are more than just bricks and mortar! Of course, the mortgage can still be paid off with the proceeds of sale if that is the right option for the family or those inheriting the property.

Retirement interest only (RIO)

This option suits those who want to keep payments lower but prefer to pay monthly interest rather than allowing it to roll up. This helps preserve the home’s equity. At Perenna, we’ve found that brokers have welcomed the option to use ‘downsizing’ in the event of the first death, which avoids the death stress test applied by some lenders (subject to minimum equity and the ability to downsize). RIO mortgages open that halfway house between a traditional mortgage and Equity Release and should not be discounted as an option. It could great solution for the right clients.

Please do not assume that older borrowers can’t be helped. In some cases, the days of paying off a mortgage at retirement with a pension lump sum are not feasible. More positively, the days of limited choices – where clients were forced to downsize or rent due to a lack of mortgage options – are gone!

Whether clients are coming to the end of an interest-only mortgage term without a repayment plan, need funds for home improvements, want to help family members onto the property ladder, secure the dream holiday, or are planning long-term estate solutions, there is now a range of options. These choices support financial freedom at any age.

This is sensible, responsible lending, supporting sensible, responsible mortgage advice.

So next time you have a client that is looking at their options in later-life. Ask yourself, whether you’ve presented all of the options.

See how Perenna can help today.

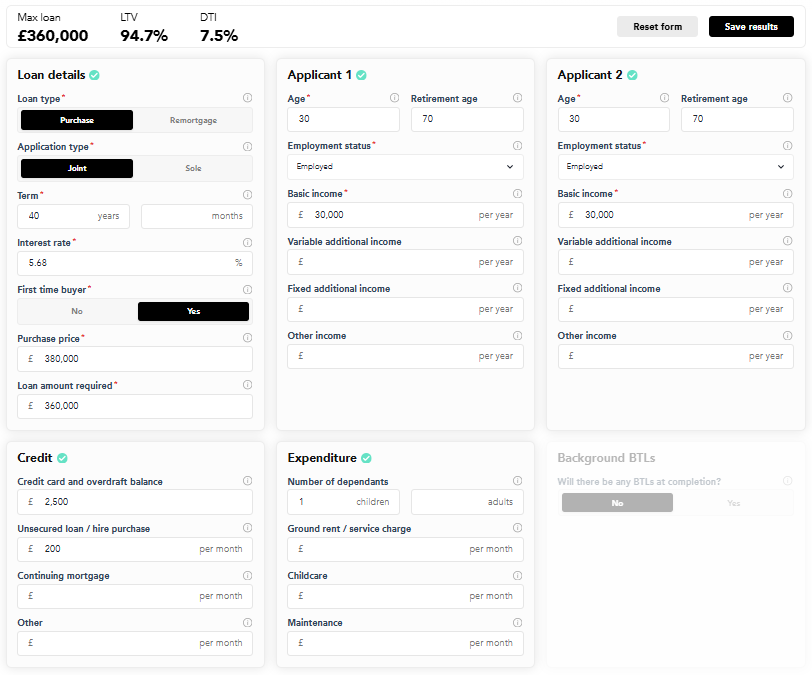

Use Perenna’s affordability calculator

Written by Perenna’s National Account Manager, Deborah Reeves

Correct at time of publishing.