On 5th November, brokers joined Janet Frame and Graham Laverty to see how Perenna’s long-term fixed-rate mortgages help clients plan with confidence and make brokers’ lives simpler.

The session showed Perenna’s strengths and how our long-term fixed rates give brokers and clients more choice and confidence.

Who was it for?

Brokers looking to:

- Understand updates to our long-term fixed range.

- Learn how our flexible criteria can support a wider range of clients.

- Refresh their knowledge of Perenna’s approach and proposition.

We had strong attendance, with engagement throughout the Q&A session. Brokers asked thoughtful questions that showed how valuable the session was for their day-to-day work.

What did we cover?

Janet and Graham opened with an overview of Perenna and our key strengths, then explained how our long-term fixed rates give brokers the tools to offer clients certainty and stability.

Key updates included:

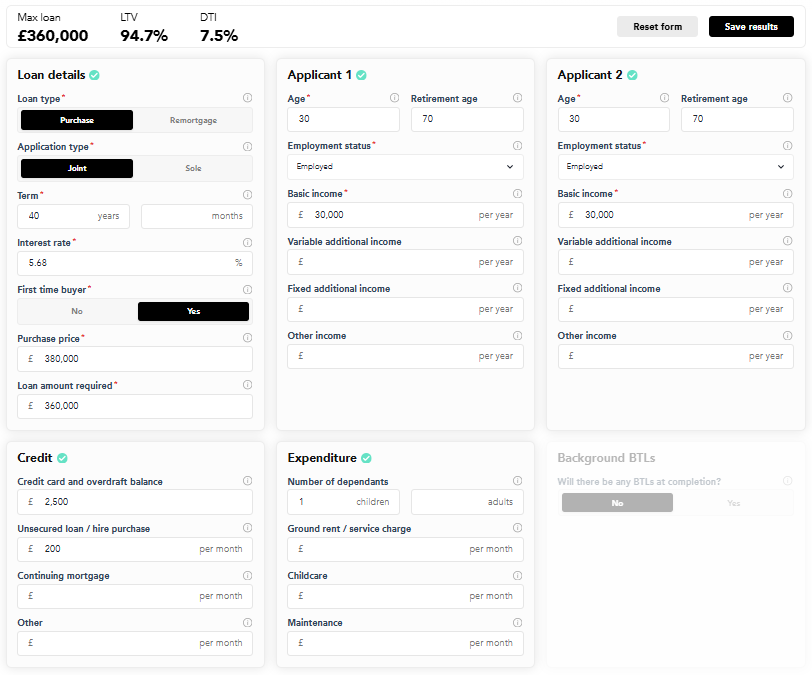

- New 7, 10, and 15-year fixed rates for more choice and flexibility

- No ERC if a client sells, moves, or repays using their own funds

- 10% annual overpayment allowance during the fixed period

- Up to 6x income (subject to criteria) at 95% LTV

Using real examples, they showed how Perenna helps clients—from first-time buyers to later-life borrowers.

Broker Q&A highlights

The session featured pre-submitted and live questions, including:

- Affordability for self-employed and older clients

- Capital raising and interest-only options

- Lifetime mortgages as repayment vehicles

- Use of cryptocurrency and gifted deposits

Janet and Graham tackled every question, showing Perenna’s flexible, common-sense approach to lending and case support.

Missed it?

Do not worry if you could not join live, we will be sharing clips and highlights from the session soon on LinkedIn.

In the meantime, explore our long-term fixed rate range here: Long-term fixed rate mortgages | Perenna Brokers

For personal support, contact our team: Contact Us | Perenna Brokers

Stay tuned for our next Perenna Live session!

Correct at time of publishing.