Affordability with Perenna’s High-LTV lending

How can you client get strong affordability with Perenna, even with higher LTVs? 28 November 2025 by Abi Walker

by Abi Walker

This case study shows how your clients can still get strong affordability with Perenna, even at higher LTVs*.

Case study overview

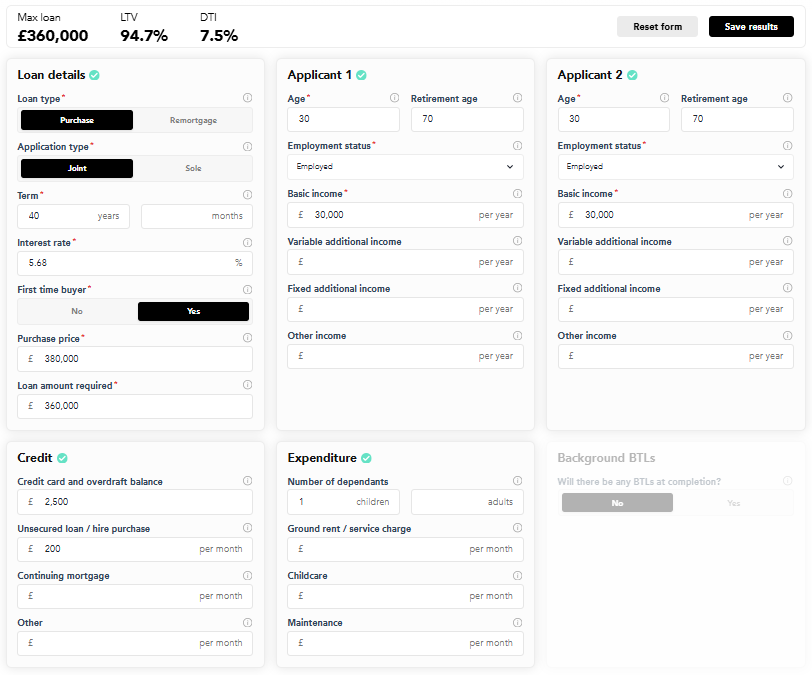

Two applicants, each earning £30k per year, are looking to buy a new home at 95% LTV.

They have:

- One dependent child

- A £200 per month loan

- £2,500 on a credit card

Despite these commitments, they are still able to achieve 6x their joint LTI with Perenna*.

With house prices growing faster than people’s incomes, buying a home is getting harder, particularly for those with smaller deposits or typical salaries. More buyers need solutions that can help close this gap in a safe and sustainable way.

How Perenna Helps?

Perenna’s Long Term Fixed Rates and Fixed for Life products are built to give families the stability they need and the flexibility they want. By fixing for the long term, customers get the confidence of predictable monthly payments, without the stress of short-term rate changes or the need to keep switching products.

Why it matters?

Helping someone buy a home is not just the mortgage transaction. It is about providing products that support long-term financial wellbeing and make that first step possible.

With Perenna, more families can access the borrowing they need in a way that is sustainable, transparent, and built for the long term.

*Subject to criteria.

Calculations correct at time of publication.

For professional intermediaries only.